With technologies revolutionizing every aspect of people’s lives, businesses need to keep up with the recent industry innovations to create quality products that are useful here and now. This article explains how financial products and institutions can benefit from software development and why digital transformation is inevitable.

FinTech market overview

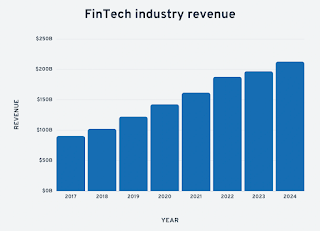

According to different data sources including Deloitte, the global market of fintech technologies is worth about $180 billion in 2022 and is projected to reach $312 billion by 2024.

Experts from KPMG calculated that global investments in fintech products reached $210 billion by the end of 2021, growing by 3.5 times compared to 2015.

Speaking of the fintech market from the consumer point of view, we, first of all, refer to the services provided to individuals and businesses. Among the most popular services that have been transformed with the help of technologies in the recent decade are:

- financial management and expense tracking;

- digital payments and fund transfer;

- taking out loans and mortgages;

- investment and trading;

- insurance and others.

Modern Fintech solutions, however, are not just about reinventing the services traditionally provided at brick-and-mortar institutions. With the digital transformation ongoing, businesses should think of implementing cutting-edge technology to stay ahead of the competition.

Most impactful fintech advancements of the recent years

The rise of artificial intelligence, the advent of alternative currencies, and demand for the finest user experience on one hand created room for game-changing advancements, while on the other established rules and standards Fintech providers need to follow.

Let’s overview how innovations influence fintech software development.

Omnichannel banking

With data growing and the number of mobile devices hitting 15 million globally, software providers definitely need to think of making the omnichannel experience a part of their development strategy.

These are a few ways in which fintech app development companies can benefit from omnichannel customer experience:

- Add login with social network accounts

- Introduce push notifications

- Make customer support options available in live chats and messengers

- Introduce two-factor authentication for online purchase confirmation

- Add ATM locator to digital banking solutions

- Develop online trading applications that synchronize with web terminals and personal mobile devices

Omnichannel experience is a proven way to build user-centric fintech products and stay competitive in the market.

AI-enabled process automation

Robotic process automation (RPA) and artificial intelligence (AI) remain top assets to provide users with smooth digital experiences and save the budgets companies used to spend on people fulfilling routine tasks.

Among the ways how automation helps bring financial software solutions to the next level are:

- AI-enabled chatbots and virtual support assistants

- System interoperability robots used for data migration

- Robo-advisors and personal finance managers

- Added functionality for automated loan processing

- RPA-based anti-money laundering solutions

AI and RPA-powered financial solutions have demonstrated higher productivity when it comes to operations, better compliance, and fewer costs. Such systems can also provide comprehensive insights into user behavior, and as a result, can help business executives make data-driven decisions.

Blockchain and cryptocurrencies

Blockchain technology has proved to be effective and secure for storing information not only in the financial domain. However, speaking of using blockchain in Fintech, we refer to a decentralized database where the record of ownership of digital assets is stored. Here are the main benefits blockchain provides to crypto-traders:

- Secure operations with cryptocurrencies

- Transparent currency exchange

- No transaction fees

- No risks related to human errors

Blockchains have already helped fintech businesses earn more, but their further growth is also something that companies operating in this domain should take for granted.

Enhanced security measures

Just like blockchains, enhanced security measures come as a response to the emerging financial technology and digital transformation. The industry deals with highly sensitive personal data, and any breach or malfunction can cost users and executives millions of dollars.

Keeping financial systems and their consumers secure has become possible by establishing and introducing the following components:

- Biometric identification by voice, face, fingerprints

- OAuth 2.0 common protocol

- Cryptographic keys

- KYC standards

Applied in combination with secure coding, testing, and cloud computing, these technological advancements open a whole new way of developing a secure fintech application.

SEE: Top Technology Leading Countries the World

Developing FinTech solutions: essential functionality and pitfalls

Developing functionality that could bring these services into the digital plane means taking subsequent technical steps and following the industry requirements.

Essential features of fintech software solutions

Financial application development differs from one business case to another. At the same time, some functionality remains the same for the majority of fintech solutions.

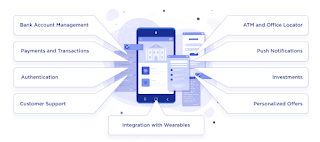

Basic features of a banking software product include:

- Login and authentication

- Account

- Card management

- Transaction management

- P2P payments

- Push notifications

- Customer support

You may consider adding functionality that covers loan and debt management, invoicing, expense tracking, advanced analytics, and investments. As the next steps, think of introducing personalized offers and setting up integration with wearables.

Some fintech solutions also provide personal finance management advisory services, digital insurance options, online trading capabilities, and more.

Important aspects to consider when developing fintech apps

Banking software development is about taking into account a number of aspects: security, industry-specific legal regulations, technical realization, usability, and marketing.

Among the most common tasks Fintechs solve at different stages of development are getting a license, building secure product architecture, establishing a dedicated fraud detection department, making rounds of usability testing, and attracting new customers.

Luckily for business executives and software providers, no innovation comes on its own, which means technical assets and community best practices are to become developers’ guiding stars in the world of digitalization.

Leave a Reply