Interlocking accounting is a system where the cost and financial accounts are maintained independently of each other, and in the cost accounts no attempt is made to keep a separate record of the financial accounting transactions. Examples of financial accounting transactions include entries in the various creditors, debtors and capital accounts. To maintain the double entry records, an account must be maintained in the cost accounts to record the corresponding entry that, in an integrated accounting system, would normally be made in one of the financial accounts (creditors, debtors accounts etc.).

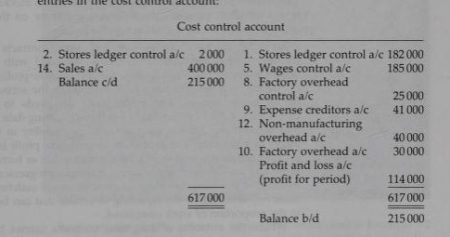

This account is called a cost control or general ledger adjustment account. Using an interlocking accounting system to record the transactions listed in Example 5.1, the entries in the creditors, wages accrued, PAYE taxation, National Insurance contribution, expense creditors, provision for depreciation and debtors accounts would be replaced by the following entries in the cost control account. See How to register For ICAN and make payments in Nigeria

SEE: Microsoft Purchase Activision Blizzard for 70 Billion USD

What Is Interlocking Accounting;5 Examples You Must Know

The entries in the remaining accounts will be unchanged. For a detailed answer to an interlocking accounts question you should refer to the solution to the self-assessment question at the end of this chapter. Sometimes examination questions are set that require you to reconcile the profit that has been calculated in the cost accounts with the profits calculated in the financial accounts. Most firms use an integrated accounting system, and hence there is no need to reconcile a separate set of cost and financial accounts. The reconciliation of cost and financial accounts is not therefore dealt with in this book. For an explanation of the reconciliation procedure you should refer to the solution to Question 5.5 that can be found in the Students’ Manual that accompanies this book.

Leave a Reply