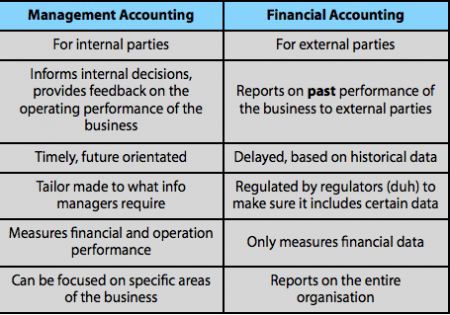

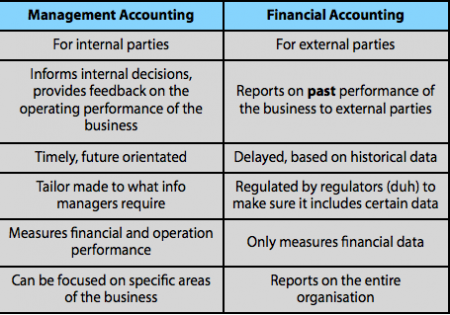

Difference Between Management Accounting And Financial Accounting.The major differences are: Legal requirements There is a statutory requirement for public limited companies to produce annual financial accounts regardless of Whether or not management regards this information as useful. Management accounting, by contrast, is entirely optional and information should be produced only if it is considered that the benefits from the use of the information by management exceed the cost of collecting it. Precision Management requires information rapidly, as many decisions cannot be delayed until the information is available. Approximate information which is processed speedily is normally sufficient for management decision-making.

With financial accounting information must be reasonably accurate otherwise external parties would have little confidence in the content of the published accounts. Consequently management accounting makes greater use of approximations than financial accounting.

Difference Between Management Accounting And Financial Accounting

Financial account reports describe the whole of the organization whereas management accounting focuses on small parts of the organization, for example individual products and ac-tivities, departments and sales territories.

- Accepted accounting principles.

With financial accounting, outside parties require assurance that the published annual financial statements are prepared in accordance with generally accepted accounting principles so that comparisons are possible. Consequently financial accounts must be prepared so as to meet the requirements of the Companies Ads and statements of standard accounting practice. Outside users must normally accept the information as the company provides it. In contrast, the management of an organization can use whatever accounting rules it finds most useful for decision-making, without worrying whether it conforms to standards or legal requirements.

Companies Acts and statements of standard accounting practice. Outside users must normally accept the information as the company provides it. In contrast, the management of an organization can use whatever accounting rules it finds most useful for decision-making, without worrying whether it conforms to standards or legal requirements.

Companies Acts and statements of standard accounting practice. Outside users must normally accept the information as the company provides it. In contrast, the management of an organization can use whatever accounting rules it finds most useful for decision-making, without worrying whether it conforms to standards or legal requirements.

- Time dimension.

Financial accounting reports what has happened in the past in an organization, whereas management accounting is concerned with future information as well as past information. Decisions are concerned with future events and management therefore requires details of expected future costs and revenues.

- Report frequency.

A detailed set of financial accounts is published annually and less detailed accounts are published semi-annually. Management requires information quickly if it is to act on it. Consequently management accounting reports on various activities may be prepared at daily, weekly or monthly intervals.

Leave a Reply